The last couple of years have been absolutely devastating for business owners, and even more so for those who run small businesses.

Whether it was supply chain issues, lockdowns, reduced hours, increased cleaning requirements, or some other kind of restriction on how businesses are run, very few business owners made it through the pandemic unscathed.

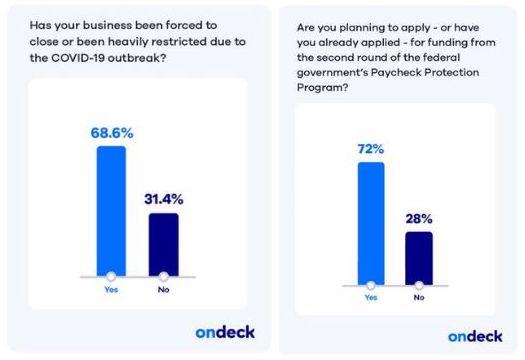

A survey from OnDeck, which took place from March through April 2020, shows just how destructive pandemic restrictions were for business owners, less than two months after the lockdowns began.

Of the hundreds of small business owners surveyed, more than two thirds of respondents reported that their businesses were forced to shut down, or were heavily restricted due to lockdowns and other public health orders.

In addition, when asked if they were planning to apply for the federal government’s Paycheck Protection Program, nearly three quarters of respondents said yes.

Unsurprisingly, despite trillions of dollars in federal pandemic relief, the funding dried up pretty quickly, and simultaneously, hundreds of thousands of businesses were forced to close.

According to a Federal Reserve analysis, between March 2020 and February 2021, business closures happened at a rate that was “about one-quarter to one-third above normal,” which translates to around 200,000 more businesses closing than would have been expected based on historical levels.

Putting things in perspective, in terms of the impact on small businesses, the analysis estimated that the “most troubled sector,” referred to as “other services,” which includes things like nail salons and barber shops, saw the permanent closure of more than 100,000 businesses “above and beyond historically normal exit levels.”

Sadly, this impact continues to be felt, even in 2022, as is shown by a U.S. Bureau of Labor Statistics survey.

The survey found that even in March 2022, well over 2.5 million Americans were unable to work because their employers closed or lost their businesses due to pandemic restrictions.

I could continue, but I think I’ve more than made my point – it’s been a rough couple of years for small business owners in the United States, not to mention the rest of the world.

But it’s not all bad news, either; at least not for businesses that stuck it out and chose to keep employees on their payroll.

Luckily, due to modifications and extensions to the Employee Retention Credit (ERC), previously made available under the CARES Act, many more businesses are now eligible to receive pandemic relief through the ERC credit.

That being said, if your business has been affected due to pandemic restrictions, and you’re wondering how you can apply for a pandemic relief program, then you’re going to want to keep reading.

Because in this article, I’m going to explain what the ERC credit is, how it works, and how you can go about applying for it.

What is the Employee Retention Credit?

Introduced in March 2020, along with the Paycheck Protection Program (PPP), as part of the CARES Act, this tax credit is intended to incentivize businesses that were able to keep their employees during the pandemic.

The IRS has access to a $400 billion fund for the Employee Retention Credit, and is authorized to provide up to $26,000 in funding for each W-2 employee.

Until recently, the ERC was poorly utilized, not least because originally, it was designed to provide significantly less funding, eligibility was restricted to only a few kinds of businesses, and employers who received the PPP or EIDL loans were not eligible for the ERC, unless they repaid their loans by May 18, 2020, which would have been practically impossible for most businesses.

Fortunately, this pandemic relief program has expanded, and the rules have changed, with the most recent amendment occurring in November 2021, making many more businesses eligible.

Even if you’ve been rejected for this tax credit in the past, as a result of these new rules coming into effect, you may now qualify.

It’s also important to clarify that this is a tax credit, not a loan, so you don’t have to pay it back, and the money can be used for any purpose.

In addition, it has no cap on funding, so there’s no limit on the amount you can receive, and even if you’ve already taken advantage of other pandemic relief programs, like PPP and/or EIDL, you’re still likely to qualify for the ERC.

Believe it or not, you may still be eligible for this tax credit, even if you sold or closed your business, or were somehow able to make more money during the pandemic.

How Does the ERC Credit Work?

Whether or not you qualify for the ERC is based on how your business operations have been affected by pandemic restrictions.

Luckily, the qualifications for eligibility have been modified, and they’re quite broad now, so most businesses are likely to qualify.

If your business has had to deal with revenue reduction, supply chain disruptions, and/or a partial or full suspension of operations, you’re eligible.

Taking this into consideration, even businesses in the retail, restaurant, manufacturing, and construction sectors are now more likely to qualify.

However, I’ve personally worked with dozens of different businesses to get them approved, including everything from franchisees and flooring companies to insurance agencies, daycare centers, churches, and doctor’s offices, helping them to receive more than $18 million in tax relief from the IRS.

Unfortunately, applying for this tax credit requires you to fill out hundreds of pages of IRS documents, and if you don’t know how to navigate this stuff, you’re less likely to qualify, or get the maximum amount of funding.

Unlike PPP or EIDL, the formulas and paperwork required to apply for the ERC are incredibly complex, to the point where many CPAs have been referring their clients to us, as applying for this tax credit requires so much specialized knowledge.

That being said, if you want to qualify, and ensure you get the maximum amount possible, you should reach out to an ERC expert, such as myself, rather than trying to apply yourself, or allowing your accountant to treat your business as a guinea pig while they try to learn how this works.

How Can I Find Out if I Qualify?

If you’re interested in this tax credit, you’ll be glad to know that it’s quick and easy to find out if you qualify, and luckily for you, I’m an affiliate for ERC Specialists.

The ERC Specialists company is staffed with trained experts who understand exactly how to fill out those mountains of documents in a way that will maximize your tax credit.

The entire process only takes about 45 minutes, and if you do qualify, you can simply follow the steps outlined below, an ERC Specialist assigned to you will do the work, and then you can just wait to collect your funds.

Here’s how it works:

- First, you need to schedule a meeting with us to find out if you qualify.

- Next, we’ll need you to provide some basic information about your business, including your average number of full-time employees for 2019, 2020, and 2021, gross receipts for each quarter of 2019, 2020, and 2021 (total deposits/sales, not including PPP funds), and the specific supply chain issues, restrictions, and government shutdowns that impacted your business.

- Then, you need to upload the required documentation, such as 941s, detailed payroll reports, and PPP information, if applicable.

- Our team of specialists will do whatever they can to maximize your Employee Retention Credit and then submit your application to the IRS.

But don’t delay! Due to a huge backlog, the IRS can take up to six months or more to process these returns, and the more businesses that apply, the longer it will take.

Are you excited to find out if you qualify for this lucrative tax credit? Contact us today to find out if you’re eligible, or click here for more information on the Employee Retention Credit.

Business Legal Concerns, Business Management, Team Management