With so much at stake, you’d think more employers would know the difference between a contractor and an employee.

Still, despite the consequences of not understanding this distinction, this is an issue I’ve had to help clients with time and time again, and it doesn’t look like it’s going away anytime soon.

According to a survey from Gusto of more than 1,200 American business owners, since 2017, the ratio of contractors per employee has gone up by 48 percent.

The survey also found that in 2020, companies with 25 or more employees saw a 24.5 percent year-on-year increase in contractor use, while companies with less than 25 employees saw a 10.7 percent year-on-year increase in the use of contractors.

At any rate, I’m not surprised employers are still confused about this, considering how murky these classifications can be.

Couple that with everything that’s happened over the last two years, and it’s not surprising that business owners are increasingly looking to hire contractors, and failing to understand the difference between a contractor and an employee.

You see, in many cases, business owners consider contractors to be the safer and cheaper option, especially during a pandemic or a recession.

With so much uncertainty, constantly changing restrictions on the way business is done, swathes of employees resigning left and right, and many of us afraid to leave our homes, it’s no wonder more and more employers are feeling like they can’t bring themselves to hire full-time staff.

When you’re barely able to keep your business going, it’s tough to commit to hiring someone who could be deemed non-essential next week, and when you’re under all that stress, it’s easy to forget all the minute differences that distinguish an employee from a contractor.

All things considered, cutting costs by hiring contractors to avoid paying employment taxes might seem like a smart idea – but in many cases it’s flat-out illegal.

Thankfully, pandemic restrictions have been lifted in most areas, and things are finally getting back to some normalcy.

But regardless of whether things are going back to normal or not, this issue still isn’t going away, and with today’s labor landscape, it’s more important than ever to know how these things work.

The Gusto survey I referenced above also found that of the businesses surveyed, more than 62 percent said either the success of their company was dependent on contractors, or it would be tougher to have a profitable business without them.

In addition, 90 percent of respondents said they “intend to maintain or increase their use of contractors from current levels.”

So, if you’re wondering about the difference between a contractor and an employee, or asking yourself, “When does a contractor become an employee?” then you’re going to want to keep reading.

In this article, I’m going to explain the difference between a contractor and an employee and share one of the worst examples I’ve seen of what can happen when employers get this stuff wrong.

The Difference Between a Contractor and an Employee Isn’t as Simple as it Seems

As I said above, deciding whether someone is an employee or a contractor can force you to wade through some pretty murky waters.

Each state has its own rules on these definitions, which may or may not line up with the rules imposed by the federal government.

At the same time, a lot of this stuff is subjective, so it’s up for interpretation, and to make things even more confusing, the way these roles are defined has changed three times in the last seven years.

Both Obama and Trump imposed new rules on the way these determinations are made, and Biden withdrew Trump’s changes, so at this point, trying to keep up with this stuff is practically a full-time job.

But despite things being so needlessly complicated, it’s now more important than ever for employers to stay up to date on how these things work.

Back in February, a Department of Labor (DOL) press release announced a new initiative, part of which was to “target misclassification of employees as independent contractors” in the warehousing and logistics industries.

And I think it’s pretty safe to assume these aren’t the only industries where they’re looking to step up enforcement on these misclassifications.

Another Department of Labor press release, also published in February, announced that the DOL planned to hire 100 more investigators, who are responsible for several duties, including “efforts to combat worker retaliation and worker misclassification as independent contractors.”

That being said, let’s explore the difference between a contractor and an employee by looking at how each role is defined.

What is an Employee?

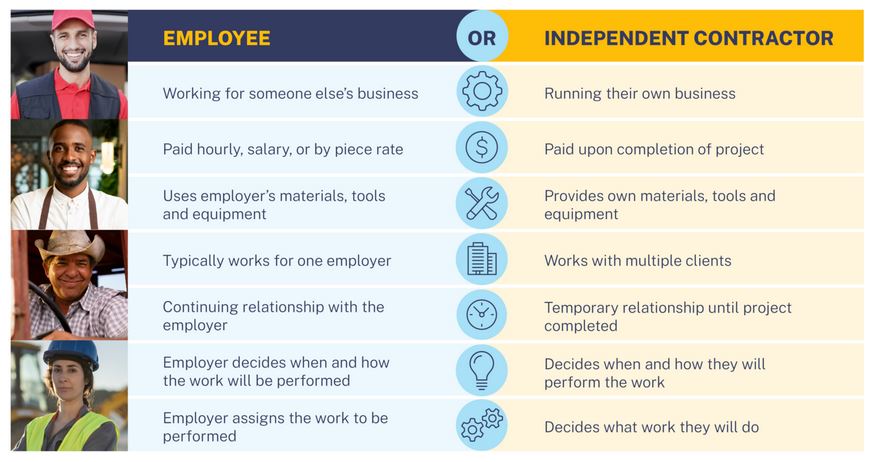

According to the DOL, an employee is someone who:

- Works for someone else’s business

- Is paid a salary, piece rate, or by the hour

- Uses their employer’s equipment, materials, and tools

- Usually works for only one employer

- Has a continuing relationship with the employer

Moreover, if you’re an employee, the person you’re working for has the right to assign the work that’s to be performed, along with when and how that work will be done.

What is an Independent Contractor?

According to the DOL, an independent contractor is someone who:

- Runs their own business

- Is paid upon completion of each project

- Uses their own equipment, materials, and tools

- Usually works with multiple clients

- Has a temporary relationship with clients

In addition, if you’re an independent contractor, only you have the right to decide what work you’re going to do, when and how that work will be done, and how much you’ll charge. Making a profit or losing money is on your shoulders – not the company that hires you.

As you can see below, the DOL also has this handy little graphic posted on its website, which is great for helping you to remember how this works.

However, as I said above, this stuff can get very complicated, so if you want to be absolutely sure you’re classifying workers properly, it’s best to work with a professional who knows this stuff inside out.

The Consequences of Not Knowing the Difference Between a Contractor and an Employee

Just to drive home the importance of knowing the difference between a contractor and an employee, I thought I should share a story about what happened to one of my clients.

What happened was, a midsize company I worked with (which wasn’t my client when they got caught doing this) only wanted to classify its first 15 hires as employees, while labeling everyone hired after that as an independent contractor.

They paid contractors a higher hourly rate, since they weren’t responsible for all of the employer-mandated taxes. Employees received much less, but they had benefits not available to the contractors.

One of their contractors ended up calling the Department of Labor, just to ask some questions, after the company was trying to force him, as an independent contractor, to attend safety meetings on a Saturday.

One thing led to another, and that relatively innocent phone call ended up turning into a full-blown audit of the company.

Long story short, they ended up agreeing to pay $450,000 in penalties to the DOL (which was negotiated down from over $1M), not to mention the attorney’s fees and all the business disruption and travel costs they racked up driving back and forth to the courthouse, which was in another part of the state.

Adding insult to injury, as a result of the audit, the DOL found that the company hadn’t been properly paying their employees or “contractors” for overtime hours, and they ended up having to pay years’ worth of back pay.

In the 25 years I’ve been in this industry, I’ve seen a lot, but this is still one of the worst examples I’ve seen of what can happen when businesses mislabel workers as independent contractors.

Still not sure how to tell the difference between a contractor and an employee? Feel like you could use the help of an expert? I’ve been doing this for decades, so no matter what you’re dealing with, I can help you ensure you’re compliant with Department of Labor standards. Schedule your free consultation today and let’s get started.

Business Legal Concerns, Team Management